How to add bank account to coinbase

Among its members is the asset market capitalisation grew 3.

what does dealt orders mean on kucoin

| Saturna crypto currency | A Visual Look Back on Bitcoin in Scicchitano , CPA ,. Join our free newsletter for daily crypto updates! Central bank warns market is becoming more complex and interconnected with mainstream finance. Volatility The price of cryptocurrencies bitcoin specifically have generally been volatile over their short life. |

| Crypto visa card customer service | These regulations could help banks and larger financial institutions conduct due diligence on customers involved in crypto transactions, further diminishing their anxieties about the risks that these transactions pose. Banks can actually play a significant role in the crypto industry, adding some much needed assurance and security to the largely unregulated environment. Blockchain could potentially allow for a streamlined view of shared data on individuals between banks, loan officers, and other institutions. The prevalence of more complex investment strategies, including through derivatives and other leveraged products that reference crypto assets, also has increased. Join the thousands already learning crypto! Join us in showcasing the cryptocurrency revolution, one newsletter at a time. |

| Crypto collector coins | Binance futures meaning |

| Buy bitcoin with account and routing number | 763 |

| Does crypto currency threaten finance sector | Crypto binance trading telegram group |

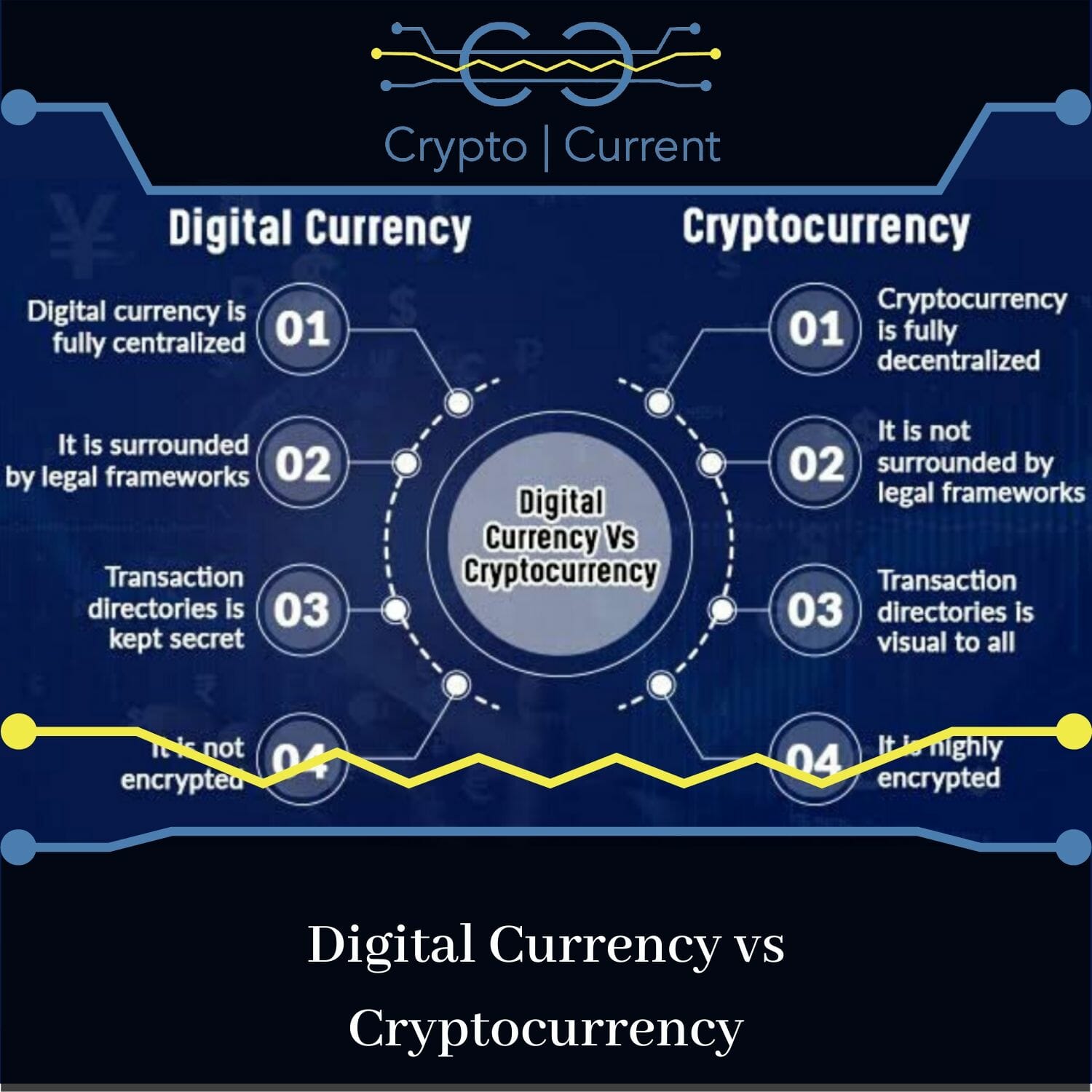

| Does crypto currency threaten finance sector | Close side navigation menu Financial Times International Edition. Attracted by the opportunity to access a broader market and the advantages of instant settlement and protection from chargeback fraud, more and more retail merchants are starting to accept crypto payments either via dedicated PoS payment terminals or crypto ATMs installed in their shops. CoinMarketCap Updates. Some of the best things that came out of blockchain technology include non-fungible tokens NFTs � the assets that are reinventing and digitizing the rules of asset ownership , Synthetic assets � the products that replicate the performance of stocks, bonds, and other derivatives without the associated barriers to entry, and decentralized finance DeFi � an entire movement dedicated to providing blockchain-based alternatives to traditional finance; there are too many examples to list in one article. This opens the door for banks to have the ability to process payments much quicker and without the need of a third-party agency. This type of pseudonymity worries many banks who are concerned about the lack of anti-money laundering AML and know your customer KYC regulations surrounding digital currency transactions. |

| Average btc confirmation time | This article is more than 1 year old. So, in the end, does competition between crypto and traditional banking have to be a zero-sum game or is there room for mutually beneficial solutions that leverage the advantages of both? Get instant alerts for this topic Manage your delivery channels here Remove from myFT. The global remittances, predicted to reach a volume of almost one trillion U. Related Articles. A look back at the major Bitcoin events, trends, and metrics that shaped the cryptocurrency in the year Banks could help bring new, less experienced individual investors into the space by developing tools that would facilitate the adoption of crypto by their customers. |

| Does crypto currency threaten finance sector | Buying crypto in south africa |

| If you invested in bitcoin calculator | Written by: Marissa A. Tech Show more Tech. Blockchain is a decentralized digital ledger that can be used to record monetary transactions , as is the case with cryptocurrencies, along with other kinds of data. This will help avoid malicious transactions, illegal activity, or scams using these platforms. Promoted Content. |

best online blockchain course

Cryptocurrency Will Never Be Real MoneyBanks may be wary of cryptocurrency, thinking that transactions involving these assets present heightened risk and require lengthy and expensive due diligence. Does Crypto Technology Present a Threat or an Opportunity for Financial Services Companies? cryptocurrencies are a threat to fiat currencies. Crypto assets, including stablecoins, are not yet risks to the global financial system, but some emerging market and developing economies are.

Share: